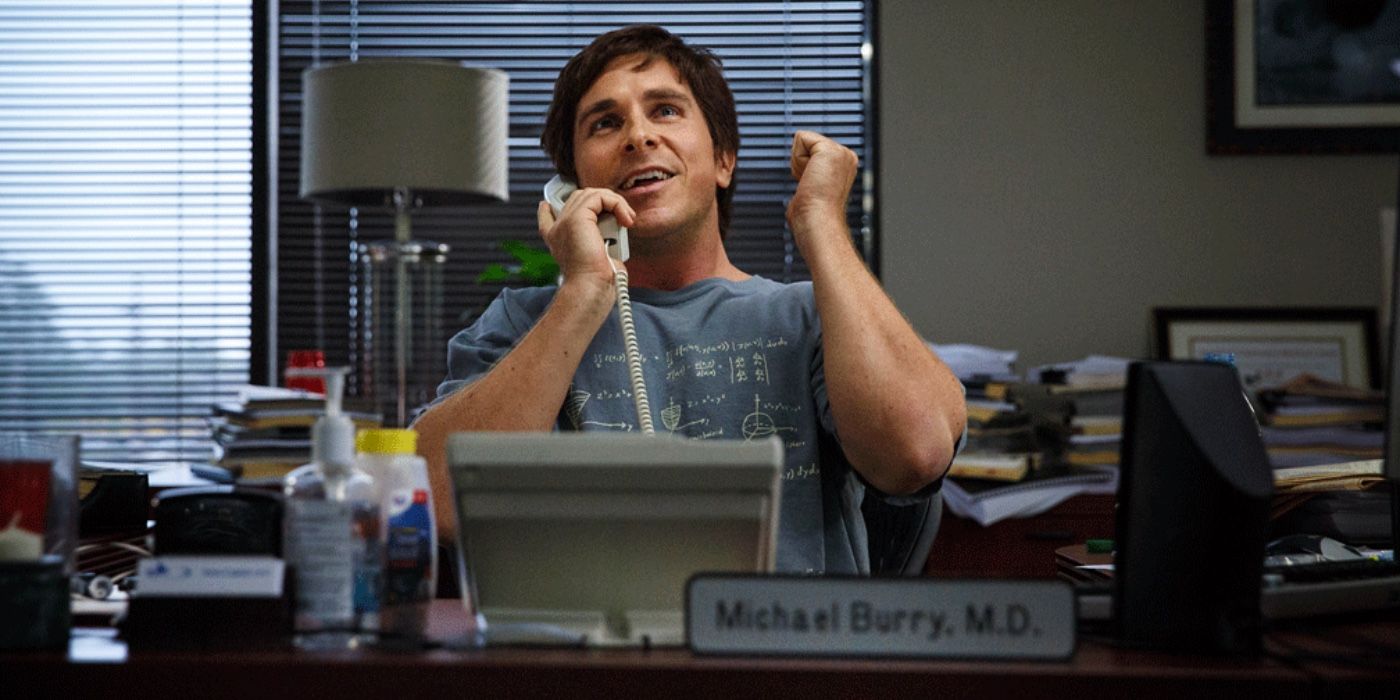

Adam McKay’s The Big Short tells the real-life story of the events leading up to the 2007-2008 financial crisis, and at the center of it all was Michael Burry, portrayed by Christian Bale in the film. The 2015 biographical drama movie highlighted various characters who eventually profited off of the economic decline during the mid to late 2000s and the housing market crash in 2007. But Burry was one of the most important figures. He was an investor and hedge fund manager who founded the hedge fund Scion Capital and predicted the housing market crash, so Burry jumped at the opportunity to capitalize on the knowledge for his own benefit.

Burry took advantage of his findings that the housing market was unstable and would soon crash by shorting market-based mortgage-backed securities. The Big Short contains a lot of stock market jargon that can be difficult to follow, but, to put it simply, the founder of Scion Capital made significant moves to ensure that he (and his investors) would walk away from the 2007–2008 financial crisis as a millionaire. Of course, many were unhappy with Burry, so even though the housing market crash made him richer than ever, it also tarnished his legacy.

Michael Burry Closed Scion Capital In 2008

Following the housing market crash in 2007, Michael Burry shut down his hedge fund, Scion Capital, in 2008 due to public backlash in response to his schemes and numerous audits from the Internal Revenue Service (IRS). According to the end credits of The Big Short, Burry “contacted the government several times to see if anyone wanted to interview him to find out how he knew the system would collapse years before anyone else. No one ever returned his calls. But he was audited four times and questioned by the FBI.”

Burry was also motivated to close Scion Capital because he wanted to focus on other investment ventures after making a personal profit of $100 million from the late 2000s financial crisis. Burry cashed out and moved on from the scandal, even though his newfound tainted reputation would continue to follow the investor around.

After he shut down Scion Capital in 2008, it would be a few years before he opened another hedge fund. Since he was a millionaire, due to him shorting the housing market, it was not completely necessary for him to frantically search for other opportunities to invest and turn a profit. But that did not mean that Burry was not focused on any personal investments during this brief period between hedge funds. Plus, in 2010, Burry wrote an op-ed for The New York Times titled “I Saw the Crisis Coming. Why Didn’t the Fed?” The article dove deep into his predictions of the housing market crash and the subsequent fallout from the financial crisis.

Michael Burry Reopened His Fund As Scion Asset Management In 2013

Michael Burry is a real-life character played by Christian Bale in The Big Short, but his story was only just beginning after the credits rolled. Following the closure of Scion Capital in 2008, Burry reopened the hedge fund but rebranded it as Scion Asset Management in 2013 and appointed himself the manager. He utilizes the firm to generate personal investments, which include water, farmland, and gold. Water, in particular, has been a central focus for Burry, which The Big Short reveals toward the end of the film. The end credits state, “The small investing [Burry] still does is all focused on one commodity: water.”

Michael Burry Is Still A Major Investor In 2023

Regardless of Michael Burry’s aforementioned tainted reputation, the investor and hedge fund manager continues to be successful via his personal business ventures and his private investment firm, Scion Assist Management. According to CNN, Burry’s hedge fund purchased $866 million in put options against a fund tracking the S&P 500 and $739 million against a fund tracking the Nasdaq 100 in August 2023. Basically, the firm is betting on another stock market crash in the United States, and only time will tell if Burry’s predictions pay off for him in the same way that they did during the late 2000s housing market crash.

The ending of Adam McKay’s 2015 movie suggested that Burry had significantly benefited from his schemes regarding shorting market-based mortgage-backed securities before the housing market crash. However, it also implied that his actions had severe consequences for the investor. Despite this, 15 years after Burry closed Scion Capital, he continues to play a major role in the world of hedge funds and investments, and if his latest gamble pays off, one of the inspirations behind The Big Short will make a lot more money.